Why Buyers Often Confuse Home Inspections and Appraisals

If you’re buying a home in Florida, chances are you’ve heard two terms thrown around: home inspection and appraisal. Many buyers assume these are the same thing, but they serve very different purposes.

While both are important in the buying process, only a home inspection provides a detailed look at the property’s condition. An appraisal, on the other hand, determines the property’s value for the lender.

Understanding the difference will save you time, stress, and potentially thousands of dollars.

What Is a Home Inspection?

A home inspection is a detailed evaluation of the home’s condition performed by a licensed property inspector. It typically occurs after your offer is accepted and before closing.

During a full home inspection in Florida, the inspector examines all major systems and components, including:

- Foundation and structure

- Roof and attic

- Electrical systems

- Plumbing systems

- HVAC (heating and cooling)

- Windows, doors, and insulation

- Interior and exterior finishes

The result is a detailed home inspection report that highlights potential safety hazards, needed repairs, and maintenance issues.

If you’re searching for a home inspection near me, remember that the goal is to protect your investment and give you peace of mind before committing to a purchase.

What Is an Appraisal?

An appraisal is an assessment of the property’s market value, ordered by the lender to ensure the loan amount matches the home’s worth. Unlike a home inspection, an appraisal is focused on dollars, not defects.

Appraisers look at factors like:

- Location and neighborhood

- Comparable home sales in the area

- Square footage and layout

- Condition of visible features (roof, siding, landscaping)

While they do make note of the general condition of the home, appraisers don’t test systems, look for safety hazards, or provide a detailed report of repairs needed.

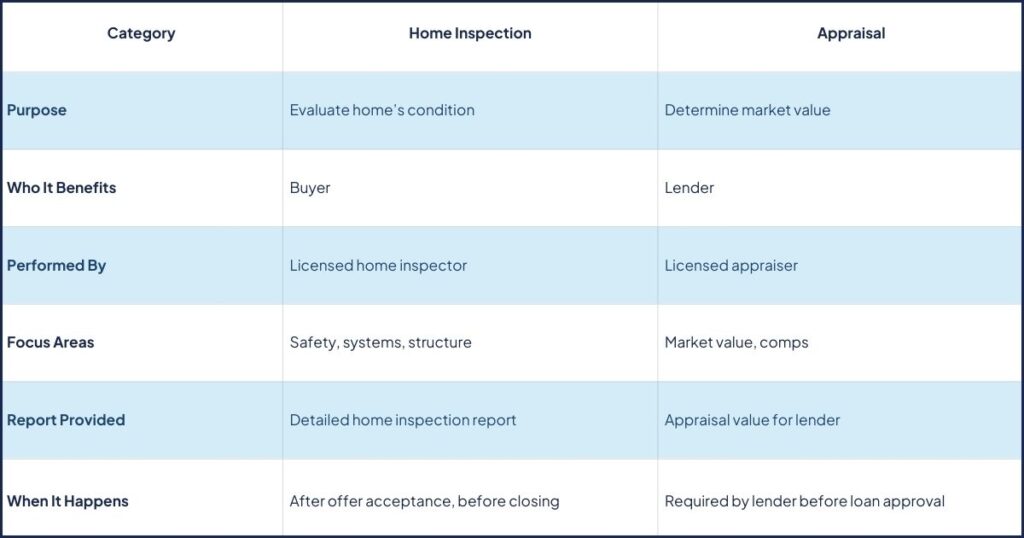

Key Differences Between Home Inspection and Appraisal

This table shows that a home inspection and appraisal complement each other, but they are not interchangeable.

Why You Need a Home Inspection in Florida

Florida’s climate, humidity, and storm risks make home inspections in Florida especially important. Issues like roof damage, poor drainage, termite activity, or faulty HVAC systems can go unnoticed without a professional inspection.

Unlike an appraisal, a home inspection gives you the power to:

- Negotiate repairs with the seller

- Request price reductions

- Walk away if major safety hazards are found

If you’re searching “home inspection near me,” you’re already taking the right step to protect your investment.

Why Lenders Require Appraisals

Your lender wants to make sure the property you’re buying is worth the amount they’re lending. If the appraisal comes in lower than the sale price, you may need to renegotiate with the seller or bring more cash to closing.

Think of it this way: an appraisal protects the bank, while a home inspection protects you.

Do You Need Both a Home Inspection and an Appraisal?

Yes, because they serve two completely different roles. Skipping a home inspection just because the lender requires an appraisal is a mistake that could cost you thousands in future repairs.

- Appraisal ensures you’re not overpaying.

- Inspection ensures you’re not buying a home with significant hidden problems.

Together, they provide a clearer picture of your purchase.

Common Misconceptions About Home Inspections and Appraisals

Myth #1: If the Appraisal Is Good, I Don’t Need an Inspection

Wrong! A home can appraise for full value while hiding dangerous electrical issues, roof leaks, or structural concerns.

Myth #2: Inspectors Estimate Property Value

Inspectors don’t determine value, they focus only on the home’s condition. That’s the appraiser’s job.

Myth #3: Both Reports Are Required by the Bank

The appraisal is required by your lender, but the home inspection is optional. However, many insurance companies in Florida often require a wind mitigation inspection, roof inspection, or four point inspection to bind a home insurance policy.

Tips for Homebuyers in Florida

- Always Schedule a Home Inspection Early

As soon as your offer is accepted, search for a home inspection near me to avoid delays in your closing timeline. - Attend the Inspection If Possible

Walk through the property with your inspector if you’re available because you’ll learn valuable details about your home, and you can ask questions in real time. - Read the Report Thoroughly

Use the findings to request repairs or negotiate a better price. Our detailed inspection reports come with clear photos and notes. - Don’t Rely on the Appraisal Alone

Remember, appraisals protect lenders, not buyers. Know what you’re buying before finding hidden issues the hard way.

Takeaway: Protect Yourself With Both

When buying a home, understanding the difference between a home inspection and an appraisal is key.

- A home inspection protects you by identifying issues that affect safety and quality.

- An appraisal protects the lender by confirming the property’s value.

If you’re house-hunting in Florida, don’t take chances and schedule a professional home inspection in Florida today. When searching for the best home inspection near me, choose an experienced company with certified home inspectors that knows how to spot the issues unique to Florida homes.

Ready for your inspection? Contact us today and make sure your dream home is safe, sound, and worth the investment.